Innovation drives competitive advantage—but for enterprise organizations, innovation without risk controls is not strategy, it is exposure.

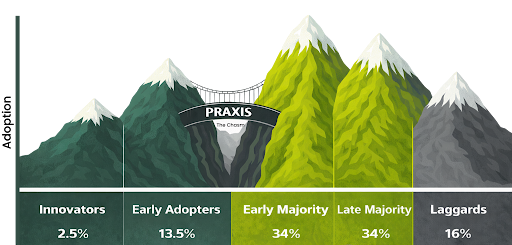

Nearly every transformative technology follows a predictable adoption pattern. A small group of innovators builds it. Early adopters test it. Success stories emerge. Then, at some point, larger and more risk-aware organizations consider deploying it at scale.

Between early success and mainstream adoption lies a critical gap: the chasm.

PRAXIS Technology Escrow exists to help technology companies and their customers cross that chasm safely.

The Technology Adoption Curve Explained

The technology adoption curve describes how new ideas move from concept to standard practice. It is typically divided into five groups:

- Innovators – Builders and inventors willing to experiment

- Early Adopters – Visionary customers who accept risk for advantage

- Early Majority – Pragmatic organizations that require proof and safeguards

- Late Majority – Risk-averse adopters driven by necessity

- Laggards – Organizations that adopt only when alternatives disappear

The most difficult transition occurs between early adopters and the early majority.

This transition is known as the chasm.

What the Chasm Really Represents

The chasm is not about technology maturity alone. It is about organizational tolerance for risk.

Early adopters are willing to accept:

- Immature vendors

- Limited documentation

- Operational uncertainty

The early majority is not.

Enterprise buyers must answer questions such as:

- What happens if this vendor fails?

- How do we maintain continuity?

- How do we defend this decision internally if something goes wrong?

Many promising technologies stall at this point—not because they lack value, but because the risk has not been adequately addressed.

Why Escrow Is a Chasm-Crossing Tool

Technology escrow does not exist to slow innovation.

It exists to make innovation defensible.

Escrow allows enterprises to separate two decisions:

- Is this technology valuable?

- What happens if the vendor fails?

By addressing the second question, escrow enables organizations to confidently answer “yes” to the first.

PRAXIS provides escrow solutions that are purpose-built for modern software, SaaS platforms, and artificial intelligence.

Key Definitions

Software Escrow

Software escrow is a legal arrangement where a copy of software source code and related materials is held by a trusted third party. If the software vendor fails, the customer can access the materials to maintain continuity.

SaaS Escrow

SaaS escrow extends traditional escrow to cloud-based platforms. It typically includes source code, deployment scripts, configurations, and documentation needed to rebuild and operate the service.

AI Escrow

AI escrow protects artificial intelligence assets such as model weights, training data, prompt logic, and supporting documentation. It helps ensure continuity if an AI vendor becomes unavailable.

Technical Verification

Technical verification is the process of reviewing escrow materials to confirm they are complete, current, and usable—not just present.

Automated Escrow

Automated escrow uses direct integrations with development systems to update escrow materials automatically, reducing human error and administrative gaps.

sFTP

SFTP (Secure File Transfer Protocol) is a manual method of transferring escrow materials over the internet. It is secure, but heavily dependent on human process and consistency.

Physical Deposit Materials

Physical deposit materials are escrow deposits delivered on physical media such as USB drives or disks. These methods are increasingly outdated and vulnerable to delay, loss, and obsolescence.

How PRAXIS Helps Technology Vendors Cross the Chasm

Technology companies face a common challenge as they move upmarket: enterprise buyers demand assurance.

PRAXIS helps vendors by:

- Providing escrow solutions that align with enterprise procurement standards

- Reducing buyer hesitation caused by vendor size or maturity

- Supporting RFP and contract requirements

- Removing escrow as a deal-blocking concern

Escrow becomes a sales enabler, not a concession.

How PRAXIS Helps Enterprise Buyers Cross the Chasm

Enterprises want innovation—but they also need continuity, governance, and defensibility.

PRAXIS supports enterprise buyers by:

- Preserving access to critical technology assets

- Ensuring escrow materials remain current through automation

- Offering verification options aligned with risk tolerance

- Supporting modern architectures including SaaS and AI

This allows enterprises to adopt cutting-edge technology without accepting unmanaged dependency risk.

Use Case 1: SaaS Escrow in the Enterprise

A growing SaaS platform becomes embedded in daily operations, customer workflows, or revenue processes. Over time, dependency increases.

The key concern shifts from “Does it work?” to “What if it stops?”

PRAXIS SaaS escrow addresses this by:

- Escrowing source code and operational materials

- Using automated deposits to keep materials current

- Offering verification for release readiness

This enables enterprises to scale reliance on SaaS platforms responsibly.

Use Case 2: Software Escrow for Mission-Critical Applications

Many enterprises rely on specialized or proprietary software with limited alternatives.

As reliance increases, traditional “checkbox” escrow becomes insufficient. Executives and auditors ask whether escrow would actually work if needed.

PRAXIS supports this transition by:

- Automating deposits to prevent staleness

- Offering structured verification services

- Aligning escrow agreements with real-world recovery expectations

Escrow evolves from symbolic protection to a practical continuity strategy.

Use Case 3: AI Escrow for Emerging Technologies

AI adoption often outpaces governance frameworks. Enterprises increasingly rely on AI models for decision-making, automation, and customer engagement.

AI escrow with PRAXIS allows enterprises to:

- Secure critical AI assets without accessing them prematurely

- Define clear release conditions tied to vendor failure

- Adopt AI responsibly while managing long-term risk

This helps AI move from pilot projects into production environments with confidence.

Where Escrow Fits on the Adoption Curve

Escrow delivers the most value at the chasm:

- After the technology has proven value

- Before dependency becomes irreversible

This is the moment when organizations must rationalize risk to move forward.

Why PRAXIS Is Different

PRAXIS is not simply a storage provider.

PRAXIS:

- Directly manages escrow agreements and administration

- Uses automation to reduce risk and human error

- Supports SaaS, software, and AI technologies

- Provides enterprise-grade controls, compliance, and insurance

Escrow should not be an afterthought.

It should be part of the technology adoption strategy.

Final Thought

Crossing the chasm is one of the most difficult moments in a technology’s lifecycle.

PRAXIS helps organizations cross it—not by eliminating risk, but by making risk manageable, explainable, and defensible.

Innovation succeeds when it is protected.

Chris Smith Author

Chris Smith is the Founder and CEO of PRAXIS Technology Escrow and a recognized leader in software and SaaS escrow with more than 20 years of industry experience. He pioneered the first automated escrow solution in 2016, transforming how escrow supports Agile development, SaaS platforms, and emerging technologies.